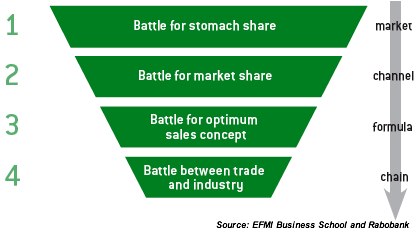

I took this title from a report on the future of Dutch supermarkets (English pdf). It identifies a number challenges to come, one of which is "stomach share," which is apparently a big deal because of the following three factors:

- Population decline: which translates into less consumers buying food

- Increased longevity: and older people have a lower caloric intake

- Increased awareness of health-issues: which also translates to a lower caloric intake.

What the authors are seeing is that players from the bottom of the market (the discounters) are moving upwards, by broadening their assortment of goods, and players from the top of the market (luxury-stores) are moving downwards, by improving their prices. A number of underlying things are going on here: luxury-stores can become cheaper by improving the efficiency of their stores and sourcing cheaper brands. And discounters can increase their offering through their relationship with suppliers.

Following HBS-quote, from an article entitled "Finding success in the middle of the market", sheds some light how Tesco does it:

A company controls midfield by fielding a complete product line that includes backs and forwards. In its supermarkets, Tesco, the successful UK retailer, offers consumers three options—good, better and best—in most high turnover product categories. In addition, Tesco doesn't just sell groceries through one-size-fits-all supermarkets. Recognizing the need to shape as well as respond to an increasingly segmented market, Tesco reaches its consumers through at least seven different store formats, from convenient Tesco Express outlets at one end of the spectrum to full assortment hypermarkets at the other. But, within all its stores, Tesco implements the same merchandising principles: Better, Simpler, Cheaper.Can you guess who the loser is yet? Well, according to both the report and much data on the net, the losers are the new, innovative concepts, that may offer certain values to consumers on an ethical or health level, but are not able to reap the same advantages as more established players are.

That is also the answer why so many organic companies are being bought up by fmcg-companies. There's an interesting overview here; but if you want to follow one in real-time, check out this Inc. magazine blog run by Honest Tea, which has recently given away 40% of their company to Coca-Cola.

Of course that is only part of the answer. Consumers are not just focussed on price. And, while consumer-awareness of the global situation and their own health is clearly growing, that's not the whole answer either. People's lives are becoming ever more complex and convenience is a big selling point these days.

It's those companies that can combine a high level of consumer-responsiveness, together with assortment and price, that will capture the hearts of consumers. But I guess what is out, is the solo single-product-serving player in the market, purely focussed on softer advantages like "ethics," and forgetting that consumers still(!) have limited disposable income for their food-expenses, as well a limited time to engage in these activities.

Filed under: branding, business strategy, Coca-Cola, community, culture, customers, entrepreneurship, food, Globalisation, operations, Research, retail, supermarkets, supply chain managment, trends, vision

"The battle for stomach share"

I took this title from a report on the future of Dutch supermarkets (English pdf). It identifies a number challenges to come, one of which is "stomach share," which is apparently a big deal because of the following three factors:

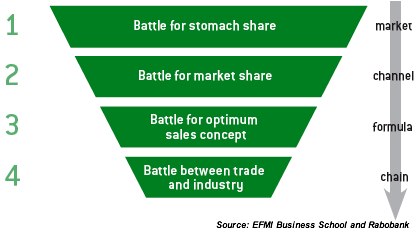

What the authors are seeing is that players from the bottom of the market (the discounters) are moving upwards, by broadening their assortment of goods, and players from the top of the market (luxury-stores) are moving downwards, by improving their prices. A number of underlying things are going on here: luxury-stores can become cheaper by improving the efficiency of their stores and sourcing cheaper brands. And discounters can increase their offering through their relationship with suppliers.

Following HBS-quote, from an article entitled "Finding success in the middle of the market", sheds some light how Tesco does it:

That is also the answer why so many organic companies are being bought up by fmcg-companies. There's an interesting overview here; but if you want to follow one in real-time, check out this Inc. magazine blog run by Honest Tea, which has recently given away 40% of their company to Coca-Cola.

Of course that is only part of the answer. Consumers are not just focussed on price. And, while consumer-awareness of the global situation and their own health is clearly growing, that's not the whole answer either. People's lives are becoming ever more complex and convenience is a big selling point these days.

It's those companies that can combine a high level of consumer-responsiveness, together with assortment and price, that will capture the hearts of consumers. But I guess what is out, is the solo single-product-serving player in the market, purely focussed on softer advantages like "ethics," and forgetting that consumers still(!) have limited disposable income for their food-expenses, as well a limited time to engage in these activities.

- Population decline: which translates into less consumers buying food

- Increased longevity: and older people have a lower caloric intake

- Increased awareness of health-issues: which also translates to a lower caloric intake.

What the authors are seeing is that players from the bottom of the market (the discounters) are moving upwards, by broadening their assortment of goods, and players from the top of the market (luxury-stores) are moving downwards, by improving their prices. A number of underlying things are going on here: luxury-stores can become cheaper by improving the efficiency of their stores and sourcing cheaper brands. And discounters can increase their offering through their relationship with suppliers.

Following HBS-quote, from an article entitled "Finding success in the middle of the market", sheds some light how Tesco does it:

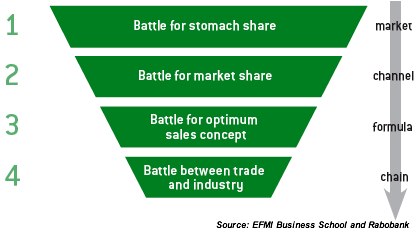

A company controls midfield by fielding a complete product line that includes backs and forwards. In its supermarkets, Tesco, the successful UK retailer, offers consumers three options—good, better and best—in most high turnover product categories. In addition, Tesco doesn't just sell groceries through one-size-fits-all supermarkets. Recognizing the need to shape as well as respond to an increasingly segmented market, Tesco reaches its consumers through at least seven different store formats, from convenient Tesco Express outlets at one end of the spectrum to full assortment hypermarkets at the other. But, within all its stores, Tesco implements the same merchandising principles: Better, Simpler, Cheaper.Can you guess who the loser is yet? Well, according to both the report and much data on the net, the losers are the new, innovative concepts, that may offer certain values to consumers on an ethical or health level, but are not able to reap the same advantages as more established players are.

That is also the answer why so many organic companies are being bought up by fmcg-companies. There's an interesting overview here; but if you want to follow one in real-time, check out this Inc. magazine blog run by Honest Tea, which has recently given away 40% of their company to Coca-Cola.

Of course that is only part of the answer. Consumers are not just focussed on price. And, while consumer-awareness of the global situation and their own health is clearly growing, that's not the whole answer either. People's lives are becoming ever more complex and convenience is a big selling point these days.

It's those companies that can combine a high level of consumer-responsiveness, together with assortment and price, that will capture the hearts of consumers. But I guess what is out, is the solo single-product-serving player in the market, purely focussed on softer advantages like "ethics," and forgetting that consumers still(!) have limited disposable income for their food-expenses, as well a limited time to engage in these activities.

Subscribe to:

Post Comments (Atom)

The

The