No comment

I've set myself a deadline:

I've set myself a deadline:

12 days to finish my thesis on "funding high-tech start-ups" !!

It's perfectly feasible, but only if I don't get distracted. So no blogging for 12 days, and hopefully I can celebrate my freedom by then.

Wish me luck!

Vincent

A few months ago, I wrote about Starbucks' vertically integrated strategy. This morning, i wanted to link to it, so I did a Google Blog-search. Usually a search for Starbucks and "vertical integration" would yield my blogpost first, but now it's the no. 2 result.

A few months ago, I wrote about Starbucks' vertically integrated strategy. This morning, i wanted to link to it, so I did a Google Blog-search. Usually a search for Starbucks and "vertical integration" would yield my blogpost first, but now it's the no. 2 result.

Somehow, the net has started discussing why Starbucks had a corporate strategy that involved owning all of its subsidiaries and Subway's strategy went a different way.

There seem to be a number of theories on the market. Namely that Starbucks

- … cares less about cross-store cannibalization

- … has a higher need for monitoring

- … relies more on “impulse sales”

- … has higher profit-margins

Some good posts about this are written here and here (both by Josh Wright), here (Stephen Bainbridge), here (Keith Sharfman), and here (Paul Jaminet)

All excellent theories in their own right, and all very rational. However, in my experience, people, and we are talking about people here, often don't behave rationally (at least not as rationally as economic theory dictates). Instead they behave in ways that they are able—either through innate capability or through their environment.

Starbucks did not start as retailer, it did not even start as a store owned by Howard Schultz. It was a coffee-bean roaster and vendor. Its aim was to educate the US-population, which was—according to Schultz—a wide open market in terms of high-quality coffee. Schultz, who first worked there as an employee, started an independant coffee-chain, and only a few years later took over the Starbucks-business (incl. the roasting factory) and the brand-name. But the core-idea remained that it had to deliver quality-products and quality-education to its customers. Along with this, Schultz was highly educated, had plenty of work-experience, and venture capital behind him.

Subway started as a retailer. According to the history, published on their site, Fred DeLuca started Subway's as a 17 year-old and $1,000 starting-capital. Subway had, as far as I know, no world-changing mission. It was a sandwich-store, one of many, and one of it's key assets was to be more efficient and qualitatively better than its competition.

I still think that the stories of these two men, their business-idea, and the environment they started it in, is the key-deciding factor of why one decided to expand wholly-owned and the other through franchising. I haven't studied Subway, but I have McDonald's, and the same dynamic can be witnessed there.

Now, you can go all "economic theory" on this, and focus on points like that coffee is a product that requires much more monitoring than sandwich-ingredients. And I think that's completely correct. Not to mention that Starbucks has a very different employee-based strategy than Subway—they like theirs to be smart and pay them well. And I also think that due to Starbucks's high real-estate presence, franchising for them has become an unfeasible solution. But I think the first two factors are the cause and the latter is the consequence of Starbucks's wholly-owned strategy.

When you start out, whether to franchise or not is a completely personal decision. It comes down to how comfortable you feel about whether you can offer your customers the highest quality possible, while maintaining healthy economic growth.

And your initial decisions will clearly have some kind of lock-in effect later on, which is something I only realised after reading the linked-to blogposts and writing my own.

Filed under: business strategy, coffee, entrepreneurship, Franchising, Globalisation, human resources, operations, real estate, restaurants, retail, starbucks, Subway, supply chain managment, USA

If you read further into the ACNielsen-report (pdf), I wrote about two days ago, you'll have seen that retailers' private label-strategy seems to be focussed on certain key-areas, namely:

- General health

- Weight-loss

- Organics / Fair Trade

- and Food for kids

At the same time, there are lot of savings on the marketing side for private labels. Retailers are in fact huge market research factories—every move that a customer makes in their store, with their products, can be entered into a database and used for future marketing strategies.

And having full control over shelf-space, shelf-placement, and in-store marketing means that the budget for these can be minimised.

All of which has three implications:

- That more of the budget can be allocated to the quality of private label products.

- That it pays off to have an elaborate in-store-system to collect consumer-data.

- And that independent product-manufacturers are perhaps screwed.

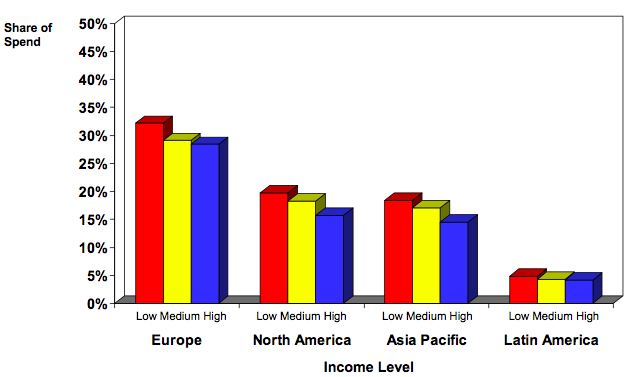

Figure 1: Private label share of spend segmented by income level (source: ACNielsen, 2005)

Of course, this doesn't mean that independent product-manufacturers are completely screwed. It puts pressure on them to become more innovative with their products and marketing than they ever were before. Which is the right kind of pressure.

Final thoughts

There's not much not to like about private labels. In many ways it's a more efficient system. Less time and money needs to be spent on the marketing-side, and more can spent on the back-end—the production. At the same time, independent manufacturers will have the advantage of flexibility. They can (perhaps) adapt quicker to market-trends, or perhaps even lead them.

Not all market-research needs to happen in the store either, some also needs to happen where the consumption happens—at home or elsewhere. And large independent manufacturers perhaps have a better foothold on general trends in society, than retailers, who are mostly restricted to what happens in their store.

(On a related note, one of my early posts on this blog discussed P&G's strategy towards shopper-marketing, worth checking out!)

So it's perhaps not a black-and-white situation. But I think that, looking at Starbucks, which is essentially a private label, that this strategy has considerable merit, because it gives retailers a lot of power over the quality of these products and how these are sold. It essentially shifts the brand up towards the retailer, instead of it remaining on the product-level.

More on this as I come across it.

Filed under: branding, business strategy, food, innovation, marketing, private labels, Research, retail, starbucks, supermarkets, suppliers, trends

Just some random thoughts for this evening…

Imax

Making 3-d films is an expensive and complex process. You need to shoot from separate perspectives, one for each eye. And it requires a specific environment to be viewed in. A dark room yes, a screen, and glasses, but most of all, the distance between you and the screen needs to be as large as possible to get the full 3-dimensional effect.

I think all cinemas should go 3-D. With home-cinemas becoming so accessible and prominent, with movie-piracy, I think the best way for a film to stay exclusive is to make it in a format that is hard to replicate at home, and where it's hard to give a copy to your friend.

I like cinemas, because they are a social experience to be shared with friends. Just like going out clubbing, or eating in a restaurant. It's a third place that has been in constant trouble since the television, the videotape and derivatives, and the internet. I hope that innovation will continue to happen, and, more importantly, will continue to be exploited.

Guinness

Give me a whiskey over a beer any day… but of all beers, Guinness is probably my favourite. It just feels like a real drink, and I fondly remember discovering it for real in Dublin, Ireland a few years ago. What I also like is that the whole process of drinking it is a ritual.

Give me a whiskey over a beer any day… but of all beers, Guinness is probably my favourite. It just feels like a real drink, and I fondly remember discovering it for real in Dublin, Ireland a few years ago. What I also like is that the whole process of drinking it is a ritual.

Guinness has been around for ca. 250 years, and it's constantly remained a niche-product. Over the last decade or so, it has tried to fight back the competition with a number of varieties, the latest of which is Guinness Red. It's supposed to be a lighter, sweeter version of the brew.

I'm sceptical. I think Guinness should try to remain special and not try to become closer to other, regular beers. But that's just me.

Pie

Lately there seems to be a revival of pie in US popular media. Last week I saw a movie, called Waitress. It's about a… waitress, who lives with an abusive husband and wants to get out. Her therapy is making pie. Every time she has an experience, she invents a new recipe to match in her head.

Lately there seems to be a revival of pie in US popular media. Last week I saw a movie, called Waitress. It's about a… waitress, who lives with an abusive husband and wants to get out. Her therapy is making pie. Every time she has an experience, she invents a new recipe to match in her head.

It's a sweet movie, worth a watch.

And then there's a new series this season, called Pushing Daisies, which is about a guy who has the power to bring people back to life… but only for a minute because then someone else has to die… it's complicated. But he also owns a pie-shop, and again this whole series is quite ingrained with this whole pie-ritual.

Not a bad series either, light entertainment until Lost and Battlestar Galactica start again.

But really, I don't get what has brought about this focus on pies and wish someone could explain it to me. What's the big deal?

Have a nice weekend!

Filed under: branding, culture, entertainment, food, innovation, interlude, media, retail, trends

It's perhaps a curious thing to say, but I think a lot of things in life depend on semantics—the meaning of words.

It's perhaps a curious thing to say, but I think a lot of things in life depend on semantics—the meaning of words.

I should actually be calling my blog "Horeca & Retail" Blog, just because the word horeca describes what I want to do so much better. Horeca is an (Dutch afaik) umbrella-term, that describes the businesses mentioned in the title: hotels, restaurant, and cafes.

I picked "food" instead of horeca, because I couldn't find an English term that described what I wanted as well. There's restaurants, gastronomy, cooking, catering, cafes, etc. but all that is too specific. Incidentally, if a knowledgeable Brit, American, or international happens to know an anglo-term as suitable as Horeca, please let me know!

Whenever I discuss my business ideas with my dad (much more inspiring than any internet-based research), we don't talk about food or retail. I begin with that, because that's what I cover in my blog, but the conversation always evolves to how to run a café or some other kind of drink-related entertainment-venue. In other words, we talk "horeca."

Here's some stuff I learned from him (he used to own some bars and cafes):

- Try to imagine your place as a theatre - you're putting on a show every night.

- Personality of ownership is important - whenever he was active in this business, he tried to look for good partners: people who understood this world and had certain social qualities.

- When looking for investors, look for breweries - this is something I'll have to research.

- Location is not the top-priority for a horeca-venue - people will come if it's worth it.

- Horeca is a troublesome business - somewhat of a general statement, which I hear from a lot of people. Basically, it suffers from weird people-related issues—lot's of stress, lot's of alcohol, terrible working-conditions, funny contractual agreements, etc. And lot's of businesses go bankrupt (well, what else is new).

So, over the next few months, next to continuing to cover certain, universally applicable, retail-topics, I'll try to find out more about how to run entertainment-venues.

Filed under: About, catering, entertainment, entrepreneurship, Europe, horeca, human resources, restaurants, retail, vision

Essentially private labels, also sometimes called house brands, are products branded either with the name of the retailer, or, at times, sharing some kind of umbrella-name, decided by the distributor or otherwise. But what private labels really represent, to me, is the ultimate example of a power-struggle between a retailer and suppliers. Sometimes, but not always, it also means that some kind of vertical integration has been taking place between retailers and manufacturers, or, at the very least, packaging plants.

For now, I'll just be looking at some stats on private labels. At a later date, I'll take a look at more supplier-retailers dynamics, branding strategies, etc.

Geographic share

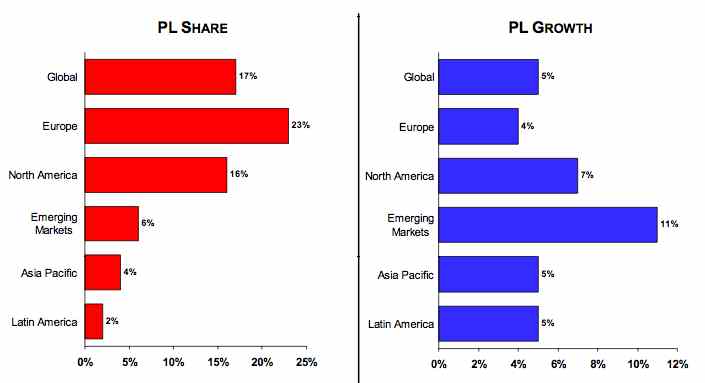

According to an ACNielsen report (pdf), the global* market-share for private brands was 17% in 2005 (* global meaning 38 countries and 80 categories), and had grown 6% that year.

Figure 1: Share & growth rates of private label by region (based on value sales) (source: ACNielsen, 2005)

Europe has the largest market-share with 23%, and Latin America the smallest, with 2%. Top countries included Switzerland, with 45%, Germany, with 30%, and the UK, with 28%. The largest Private Label growth happened, unsurprisingly, in emerging markets (11%) like Croatia (77%), Greece (24%), and Thailand (18%).

One big growth-contributor in Europe is the strong growth of hard discounters, such as Aldi or Lidl (both German chains), who are present in every European country and expanding rapidly. With Aldi, for instance, private labels make up 95% of sales.

Private label foods

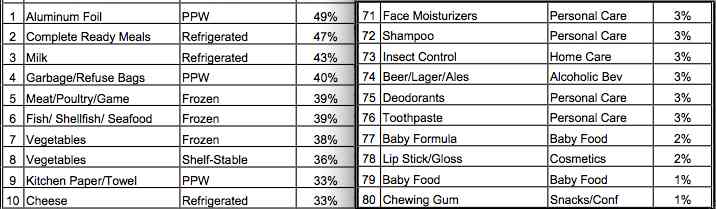

Category-wise, refrigerated foods have the largest overall share of private labels, namely 32%. Complete ready meals take the lead here, with an average of 47% private label-share. In the UK, 97% of ready-meal sales are in fact private label.

Another significant private label food, or rather drink, was milk, of which private labels make up 43% of sales.

Figure 2: Value shares of private label by category (source: ACNielsen, 2005)

Other high private label food-products include frozen meat (39%), fish (39%), and vegetables (38%), and 37% for shelved vegetables. Frozen pizza is at number 27, with 17%, tea and coffee at numbers 37 and 38, with 14% and 13% respectively. Wine is at number 44, with 12%. And Beer is all the way at the bottom, at number 74 with 3% !

Among the fastest growing foods are drinking yoghurt (28% growth), baby food (20%), chocolate (13%), and water (13%).

Pricing trends

One of the strengths of private labels is of course that they are cheaper, on average 31% less than manufacturer brands. Emerging markets showed the biggest discount, with PL-goods costing 41% less on average. Europe wasn't lagging in this respect either, with an average price difference of -37%. On a country level, Greece, Australia, and Germany were taking the lead with, respectively, -48%, -47%, and -46% discounts (compared to manufacturer brands).

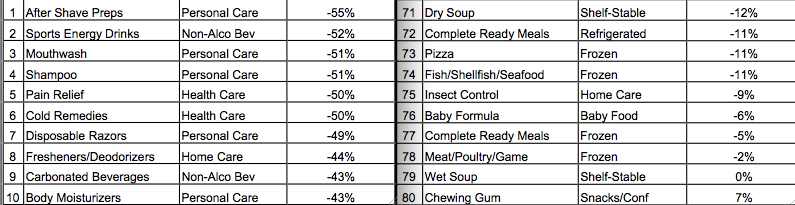

Figure 3: Price differential of private label by category (source: ACNielsen, 2005)

Again, concentrating on food-categories, the products that received the biggest discounts were Sports Energy Drinks (-55%), carbonated beverages (-43%), cereals (-40%), wine (-38%), and tea (-37%). Food-categories taking the least in discounts, included chewing gum (+7%), wet soup (no difference), meat (-2%), and ready meals (-5% <- I guess that explains their high market-share).

Final thoughts

That market share is increasing more quickly in emerging countries is not surprising. Retailers there will likely not be mature and/or consolidated enough to focus on such a strategy, but this is clearly changing.

Germany's dominance is also interesting, as both Aldi and Lidl originate from there. One of my next posts will be on Ikea's European growth and Germany's also very strong there, which suggests a certain preference for low prices with German customers.

Switzerland is still somewhat of an enigma, but I'll try to find out more about it.

In terms of products, both the dominance of private labels amongst ready-made meals, and that their prices are quite similar to regular brands, is very interesting. It could suggest that customers either don't care much for quality and brand-differentiation in that sector, or that private label brands are actually quite good. The price-level would suggest the latter conclusion.

Generally speaking, refrigerated goods are different in the eyes of consumers, I think, less scrutinised perhaps, and worthy of more investigation. Milk is of course similar to water, and hence not really a product where brand makes a huge difference.

What else? Certain beverages, like coffee, wine, and beer are quite interesting, as their private label share is quite low. This would suggest a high brand-sensitivity in these sectors. The low percentage for beer (3%) is certainly striking.

More on private labels as I come to it.

Filed under: branding, business strategy, Europe, food, geography, Globalisation, logistics, marketing, private labels, Research, retail, supermarkets, suppliers, supply chain managment, trends, USA

This week, I seem to be taking somewhat of a personal angle, where I express my own views, rather than report and analyse those of others. I'm not sure if this is good or bad, but, after reading Fred Wilson's view on it, I think it's sometimes necessary to instil some personality into a blog.

This week, I seem to be taking somewhat of a personal angle, where I express my own views, rather than report and analyse those of others. I'm not sure if this is good or bad, but, after reading Fred Wilson's view on it, I think it's sometimes necessary to instil some personality into a blog.

One thing in life that I am very sceptical about is marketing, and there is one particular kind that annoys me the most. I call this argumentative marketing, and I define arguments as:

Constructing a logical set of information, meant to replace the logic present in the mind of the audience.In other words, arguments often serve the purpose of distracting or confusing the person or group they are targeted at.

That it is not meant as arguments not containing any information! No, I think knowing that a knife can cut through a metal can of food is quite interesting! But if I were a chef and all I wanted to do is chop vegetables, and I already had a perfectly good knife, this information could also be considered distracting.

Arguments are very prevalent in our global society. Not only is advertising the number one business-model in on- and off-line media, but there are quite a number of jobs centered around constructing arguments. Take students, lawyers, politicians, consultants, marketeers, sales-people, a certain type of manager, etc. And let's not forget bloggers!

And I think the market for arguments, people, is quite saturated with them also, meaning that the value of arguments is constantly decreasing.

As always, this means that other opportunities open up, which some marketeers are already exploiting. Let's not market at all!

One way to do that would be to simplify the argument to the essentials. Have the product or service itself tell the story, by illustrating clear and simple values, which customers can grasp and share with the rest of the world.

Examples are:

- Google-search: just search

- iPod: 1 button-play

- Fast-food: colourful, good-smelling food and drinks, easily accessible (there does seem to be a trend towards more info, but I'm seriously doubting that it will last, or that it matters to 98% of customers)

- Amazon's Kindle (still sceptical): one click shopping anywhere (in the US)

- And, last but not least, the lack of title-sequences in the series "Lost," and pretty much any movie or series afterwards!

The picture is courtesy of allaboutadtips.com

Christine Huang, at the "Trends & Innovation agency", PSFK, points us to a commercial film, shot by Unilever's Axe and featuring David Spade. The subject is… I would guess, food presented in a dirty and sexy package.

Just like Christine, I'm not sure I get it. I don't think it's aimed at European audiences either. But, all in all, definitely an interesting 5 minutes of your life.

The only question I have: So are you guys gonna take a shower now or what?

Incidentally, if this is the first post of mine you're seeing today, also check out my post on Amazon's Jeff Bezos just below.

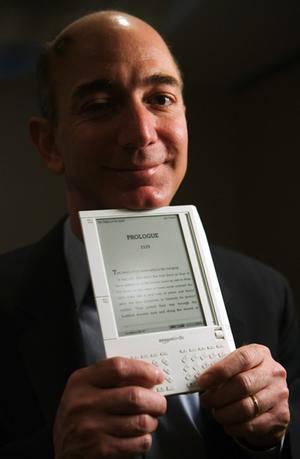

Amazon's Jeff Bezos on strategy & innovation (not Kindle-related!)

0 comments Posted by Unknown at 1:44 PM I'm writing this post for two reasons. One is that I am incredibly interested in the subject of leadership and try to learn about it in whatever way I can. A second reason is that, even though my main focus on my blog is food and retail, what Matthias calls "old economy" (thanks Matthias!), I try to also be very aware of "the past, present, and future of this industry," and (internet-)technology plays very much a part in the future of retail.

I'm writing this post for two reasons. One is that I am incredibly interested in the subject of leadership and try to learn about it in whatever way I can. A second reason is that, even though my main focus on my blog is food and retail, what Matthias calls "old economy" (thanks Matthias!), I try to also be very aware of "the past, present, and future of this industry," and (internet-)technology plays very much a part in the future of retail.

In terms of leadership, Amazon's Jeff Bezos is a good person to study—a man who created perhaps the most iconic garage-based venture since Apple, and who managed to not only take his company, Amazon, public, but also stay on as CEO until now, something that is rare amongst founders. In terms of retail, Amazon is itself great company to study. It has transformed the book-industry, and is doing amazing work in terms of providing infrastructure for web-based infrastructure. And, even though they are not as yet selling any books in the Netherlands. I'm hoping that SEPA, to be introduced next year, will change that.

Before I continue, this is not really a Kindle-related post. While we're on the subject, however, let me say that I'm a big fan of ebook-readers. At the same time, there are certain advantages to paper-reading, which I'm especially experiencing since I started my own blog—namely that I can write on them. I know I can take notes on Kindle, but it's not the same. And I think the price-point of either the device ($400), or the books (a $10 intro-price), or both, is just too high for something that can be produced in mass and has no printing-, and hardly any distribution-costs attached to it.

Speaking of notes, I took some while reading a nice HBR-interview with Jeff Bezos, in which he discusses his take on strategy, innovation, customers, ... and not Kindle. I'll share these, and my thoughts on them, with you now.

Innovation at Amazon

There are generally two types of innovation, the radical kind and the incremental (or process) kind. My general belief is that, while retail on the internet radically transformed the way we shop, and will continue to do so, ultimately it is an evolution in process. Instead of giving our credit-card to the clerk, we type in a number behind a screen, etc. etc. And, since the internet has taken off, this kind of process-innovation has become much more prevalent. Now, instead of clicking 5 times to buy a product, I can click once: yay! Before you ask, "so what is 'radical' innovation to you?" I'll just say: "Space, flying car, people living under water, that kind of stuff. So get busy!"

Amazon has of course just announced the Kindle, which could be interpreted as an innovative move. But again, what will make this innovation shine, if it does, is Amazon's incredible process-strength, namely that they can deliver the device to nearly every household in the Western world at beautiful economies of scale. For now, these are paying of for Amazon, but knowing their business-model, it's pretty certain that this will pay off for consumer too… eventually.

What I like about Amazon (and got from the interview) are that they have an incredible experiment-based culture and generally take a long-term view—both rare with public companies. In terms of experiments, these are encouraged on a company-wide level, and due to the nature of experiments, are both had to predict and not unknown to fail. One example of an experiment which became an enormous, but unplanned, success, is the Amazon-associates program.

As far as time-frame is concerned, innovations at Amazon usually take 5-7 years before they make any meaningful impact on the company's economic situation. This is a big risk and is offset in a number of ways. One is to minimise the costs of experiments. Amazon has a web lab just for that purpose, which undertakes these experiments on a massive scale, collects real usage data on what works best, and is constantly trying to push the costs of these experiments down. Again, taking a long-term view, it helps when building innovation on things that won't change in the next 5-10 years. For Amazon, these are basic customer preferences, such as: choice, low prices, and fast delivery (hello Kindle?).

There are three more core-attitudes, which I think have a big impact on the way innovation takes shape at Amazon. One is, to always ask the question "why not?" According to Bezos, the biggest mistakes at Amazon come from not doing something, rather than taking the risk. And asking "why not?" instead of "why should we do it?" opens up a whole other universe of possibilities. Similarly, there are lot of difficult decisions that Amazon has had to make over the years, such as allowing reviews on their site. The vital question there was "what is better for the customer?" Last, but not least, I like this line in regards to making experiments a success: "Be stubborn on the vision, and flexible on the details."

Strategy at Amazon

The other part of innovation is execution, some of which was already discussed above. Much of decision-making comes out of the way a corporate culture is shaped. Some cultures are hierarchical, some are flat, some are individualistic, some are collective. From my understanding of things, Amazon has both a departmental structure (which would suggest some hierarchy) and takes decisions collectively. Both senior management and departmental management have mechanisms through which this collectivity manifests itself. Seniors meet once a week for four hours and once-twice a year for a two-day meeting. Homework is assigned before and the latter type of meeting deals mostly with long-term issues. Department-management has a similar system.

Some more general characteristics of corporate culture were mentioned in the interview, namely that they can be incredibly stable over time, and are self-perpetuating in the sense that they attract people who like that culture (and repel those that don't). While a company's corporate culture is probably the hardest to replicate, and can thus be a tremendous competitive advantage, the rigidity of the culture can both mean that there are limits to what it can do (and should do), and it can sometimes hamper innovation during turbulent times. At the same time, a culture can by nature be open to change, which should overcome some rigidity.

A few weeks ago, on my blog, I wrote a post on Porter's five forces in which I outlined what I think matters in strategy, but also that it pays off to stay close to customers. Jeff Bezos shares a similar view-point, for a number of reasons. One, customer-needs change more slowly than a lot of other things, e.g. tech; and two, following the competition doesn't work well in fast-changing environments, e.g. tech. A third point is that being too competitor-focussed can result in a passive attitude once a certain dominance has been reached in an industry. You can argue about this either way, but when you look at certain large companies (no names), this "hey, we won, so why innovate?"-attitude, is definitely one that is recognisable.

One way that Amazon tries to stay close to customer-needs is by enforcing rotation. Every new employee has to spend time in their fulfilment-centres with the first year, every two years, employees have to do two days of customer service, and everyone has to be able to work in a call-centre. That includes Jeff Bezos.

Finally, he also had some advice as how to survive the transition from the founder of a start-up, to the CEO of a multinational, public company. It's simple (yeah right!). When you start, the main question is "How?"; as you grow, the question is "What?"; and when you're huge, the question becomes "Who?" There you go, the secret to being the leader of a big company.

Final thoughts

One of the weaknesses of secondary information, such as what came from this interview, is that I (and you) have to trust everything that is in the article. I can't ask follow-up questions and can't tell, by body-language, tone, or otherwise, whether some points are more important than others, or more true than others. Therefore I try to be careful to treat each piece of information as part of a greater whole. In other words, I may come across information that conflicts with what Bezos said in the interview. If it's noteworthy, I'll write a new post about it. One piece of important data, released perhaps a month after the interview, is the release of Kindle, which, as mentioned, I am sceptical of.

Two things I learned from the interview is that innovation takes time, especially to make it economically viable, for both the business and the consumer. In my opinion Kindle, in order to fit the philosophy of Amazon (which is not Apple after-all), has to drop in price, as do the books. It's a matter of ethics, of being customer-focussed, and of being a process-innovator. I can only assume, that over the next years, this is exactly what will happen.

The other thing I learned is to constantly be open to innovation that can benefit the customer. This point has been made many times in the words above, yet it bears repeating. A company can be incredibly rigid, the bigger it becomes. Competition can become incredibly threatening. Technology can change from one day to the next. But what doesn't change is that customers will pay you for products that make them happy. And I fear that a lot, a lot of businesses have forgotten that as they became big, arrogant, and focussed on anything but what customers want.

Finally, while I may be focussed on "old economy" topics, I think Amazon teaches some interesting lessons on how to remain high-touch in a high-tech environment. As such, this certainly won't be the last time I touch upon the topic of technology in retail.

Further reading

If you're interested in the topic of leadership, you mean also want to check out a list of free podcast-interviews with a number of CEOs, ranging from Google's Eric Schmidt to, indeed, Jeff Bezos, which I posted on Tech IT Easy a few months ago. Worth a listen. Oh, and don't forget to check out the original article on HBR.

This article is mirror-posted on Tech IT Easy.

Filed under: Amazon, books, business strategy, customers, e-commerce, entrepreneurship, ethics, human resources, innovation, logistics, management, media, new business development, operations, retail, technology

Today should be called Meta-Monday… I seem to be in some kind of reflective or introverted mood. And as any blogger probably knows, moods and blogging, that's like a burger and fries—they go hand-in-hand. But no worries, tomorrow it's business as usual.

Today should be called Meta-Monday… I seem to be in some kind of reflective or introverted mood. And as any blogger probably knows, moods and blogging, that's like a burger and fries—they go hand-in-hand. But no worries, tomorrow it's business as usual.

One thing I discussed in my last post was finding a job. Yesterday, during a jog, I thought it would be a good idea to crowdsource my application-letter when the time comes. I'm not sure if it's the best idea—no one I know does it, and probably for a good reason—but I'll consider it.

Another thought I had yesterday, was on the type of job I would be looking for. I already wrote about "one with broad development-opportunities," but that doesn't say anything about where to start. Yesterday, I actually argued with my father about this, as his vision of my vision is somewhat different of my vision of my vision—if that makes sense. Essentially the conversation went somewhat like this:

Me: "So, what would you guys think about me getting a job at a place like Ikea (just an example, don't get any ideas!)?"

Dad: "That's idiotic. If you want to start a restaurant, you should just start one. No detours. What does Ikea have to do with a restaurant anyway?"

What does Ikea have to do with a restaurant anyway?

That's a good question. First of all, I'm pretty sure I don't want to start a restaurant. Everything I've seen so far leads me to believe that it is a terrible environment: People are stressed and unfriendly, chefs are arrogant, long hours even after a start-up is no longer a start-up, etc. I might change my mind, but that just doesn't fit my vision.

Second, my attitude on business is that the product doesn't matter. But that said, I am more passionate about some products than others, namely food, media-related stuff, technology, etc. and I care a great deal about the atmosphere of the place.

So what does Ikea have to do with a restaurant? It sells goods to customers, which it sources from suppliers. It thinks about the customers, it competes with other businesses, it expands nationally and internationally, it works with suppliers, etc. Not to mention that it also has a restaurant. It's a business and its principles are just as applicable to a restaurant or any comparable business. The product doesn't necessarily matter.

That doesn't mean I want to work at IKEA per se, I'm making a different point.

Meet Mr. Generalist

The stereotype of a generalist is probably that he or she cares about everything and anything. I, being a generalist myself, don't agree with that. Instead a generalist, to me, means:

"To care about nothing specifically, instead to care about everything that produces an outcome. In business this means to care about the four dimensions that I mentioned in my last post: the components of the business; the value chain; the past, present, and future of the industry; and how people fit into the picture."That said, nobody cares about nothing and the more experience you get, the more you will care about certain areas more than others.

In terms of people, I am constantly on the look-out for specialists—people with in-depth knowledge about a certain field—and to some extent generalists—people who also have a broad view about what makes a business function. The phase and size of a business certainly affects the need for either type of person. I can't say much more about this, except that just to find the best (wo)man for the job, is always the right attitude.

In regards to finding a job, being a generalist (probably) puts me in a similar conundrum to when I studied strategic management. There are no starting jobs as strategists, and I'm not sure that—at least in large firms—there are starting jobs for generalists either.

I think that I will have to decide in what function I want to start in and see what happens from there on in. I'm thinking logistics, but I will keep an open mind.

The image is courtesy of acponline.org

Filed under: About, business strategy, career, entrepreneurship, operations, retail, self-development, vision

A blog is a service—both to me, and to you, the reader. To me, it serves as a way to collect a large amount of information, and, more importantly, process it so that it stays in my brain. The better, and more focussed the information is, the more it helps me, and the more it becomes useful as a general information-source for you too. There are a couple of specific goals I have, which will certainly affect the status and value of this blog. These are, as follows:

A blog is a service—both to me, and to you, the reader. To me, it serves as a way to collect a large amount of information, and, more importantly, process it so that it stays in my brain. The better, and more focussed the information is, the more it helps me, and the more it becomes useful as a general information-source for you too. There are a couple of specific goals I have, which will certainly affect the status and value of this blog. These are, as follows:

1. Develop a framework of how everything in a food- and retail-business fits together

The reason why I write about a large number of topics is because I see any business as system or a machine made up of a number of components. I need to think on four dimensions: the business-components; the value chain; the past, present, and future of this industry; and how people (incl. me) fit into the picture.

Implication: This simply means that my broad coverage of topics will continue, but that the implicit understanding is that it all needs to fit into one of these four dimensions. It also means that, in addition to researching these topics, I need to start converting the broad framework I have in my mind, to paper.

2. Gain practical experience

I see this on two levels. One, I need to seriously understand the process of retail or food business from start to finish. The best way to accomplish this is to learn by doing. This can be achieved in two ways: the more logical one would be to work at a business that offers a good amount development opportunities—allowing me to see many aspects of that business; and eventually I see myself starting my own business also. The second reason why practical experience is important is reputation. This business in particular is pretty resource-intensive. To start a business you need to have access to a good network of people, and investors. Both trust you more, the more practical experience you have. Put your money where your mouth is.

Implication: This is still some months off, because I still need to finish some business before that. When it does happen, I think it will affect the blog in two ways: one, I will have less time to blog. And two, I will have more practical data that I can share (within reason).

There is a third point—starting my business and everything that involves, but that's a topic for another day. For now, if you have questions or comments about the above, feel free to share.

This blog will continue as usual for now. Expect a new post tomorrow!

The non-sensical picture is a few months old… until I get my camera back from the store (any week now), my ability to draw and and scan into the PC is somewhat constrained.

Filed under: About, blogging, business strategy, career, entrepreneurship, management, operations, restaurants, retail, self-development, tools, vision

5 Links: human sigma, link-baiting, neuroscience, brand experience, wine

0 comments Posted by Unknown at 11:47 AM While I'm stuck on writing some other posts—the idea is there, the execution some way off—it is time for another collection of links.

While I'm stuck on writing some other posts—the idea is there, the execution some way off—it is time for another collection of links.

- Using Human Sigma for measuring customer engagement - Mitch Owen reviews a new book on the market, that suggests that evaluating our efforts at customer satisfaction happen on four levels: Confidence, Integrity, Pride, Passion.

- How to coast to a writing career - Valleywag writes an insightful post (for once) about what matters when blogging. I like "AVOID: Blogger ego. If you do blog, just write and forget about it. Don't reply to your comments with more than "Good point, h8rboi, thanks. Don't troll other bloggers for links, or try to get onto Techmeme by posting about whatever's already there. ... People in the real media don't care what your Technorati rank is, they'll just Google you to see what you write." That said, I have no intent to engage on a writing career.

- Mind hacks: an interview with Jonah Lehrer on neuroscience - What I like: "Artists are constantly being forced to reverse-engineer the brain. By reverse-engineering the art - by trying to understand why, exactly, it resonates with us - we can learn about the mind."

- Thirteen examples of successful brand experiences - could be filed under architecture. The British design council points us to 13 different "experience-castles" (my own term), where customers can be enchanted.

- Calculating the carbon footprint of wine - What can I say? It's the new world! Some key-points: organic is not as efficient as we think; distance matters; packaging matters.

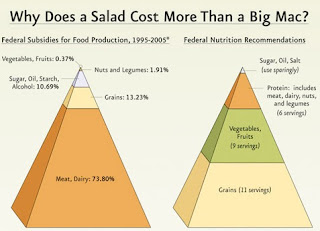

- Bonus Link: Why does a salad cost more than a big mac. - A picture says more than a 1000 words. This is just as applicable to Europe btw. Thank Wolsey for inventing the subsidy!

Enjoy! More of this: check out the S+FnR bookmarks—updated 24/7 !

After my little over-academic look at the cost of real-estate this morning, I thought it would be nice to lighten the mood a little. Check out the video where:

"The New Frontier casino-hotel was imploded early Tuesday, giving a violent end to the second property to open on the Las Vegas Strip. This, to make way for a multibillion-dollar resort bearing The Plaza brand, set to open in 2011."(via Missethoreca.nl)

On a related, but perhaps more aesthetic, note, you might want to check out New York Magazine collection of vintage videos on architecture, ranging from the Brooklyn Bridge in 1899 to the construction of the World Trade Center in 1966-73 (via Kottke).

Still following the great book on Retail Marketing, by Dr. P. McGoldrick, this time I'll cover the different types of cost that are included in buying, developing, and running retail locations. For previous coverage, check out post I and II

Still following the great book on Retail Marketing, by Dr. P. McGoldrick, this time I'll cover the different types of cost that are included in buying, developing, and running retail locations. For previous coverage, check out post I and II

Before buying property, considerable data analysis must happen in regards into estimating turnover, which comes from data on competition, accessibility, and population. And a calculation of costs must happen, least of which is the purchase price, and more complex will be three types of cost: development costs; running costs; and contextual* costs (*: for lack of a better word).

Much of this cost data will likely come from negotiations with site developers, lease owners, and an estimation of the costs involved in the development of the location.

Naturally, with the proliferation of the internet, there are plenty of databases that offer interested parties an overview of typical sums per region or type of location. Though the following are mostly aimed at private individuals, both My-Currency and Zillow offer these types of services, and Jeremy Fain wrote about a French service, called BMyKey.com on Tech IT Easy.

Purchase price

Traditionally, rent bid theory explains a lot of price-differencials within an inner-city environment. Variety and women's clothing stores would typically pay the highest rents and grocery stores the lowest. With the emergence of superstores and their focus on out-of-town locations, this formula can not be applied so generously anymore, though, as mentioned, I think that it should logically still apply to inner-city environments, and probably to inner-malls ones also.

And while buying the property may cost a certain sum, it is not atypical that the three of the following types of cost will far outweigh the initial purchase price.

Development costs

Three types of estimates need to be made here: design estimates, which include the costs of the architectural work; bid estimates, which involves negotiating the costs of labor, material and equipment; and control estimates, which are the costs of monitoring the project-development. For more info on these, check out this document.

In addition to this there are a number of costs that can be substantial, but are sometimes not taken into account. One is site preparation, which be steep, especially if the land needs to be converted or extensive demolishing needs to take place.

In addition to this local authorities can impose a number of restrictions on the height of the building, other architectural and landscaping aspects, and demand significant concessions from retailers to build there. All of which can at the very least slow down development considerably.

Running costs

The choice of location, site, and design can greatly affect the cost of running the operation once it's constructed. For instance, multiple floors and parking will mean that lifts will need to be maintained regularly. A location with a high crime-rate will require higher security-costs and lead to more theft. And high employment and income areas will also lead to issues regarding staff recruitment and retention.

Contextual costs

I made up this term, but it actually includes costs like delivery, promotion, and the impact on other branches of the business. Delivery costs are affected by the location choice of the outlet—how accessible it is via road or otherwise; how remote it is from the main distribution network. Promotion costs are also a factor (but a topic for another day). And the impact on other branches are a very important factor to consider. The higher the existing market-share in an area, the greater the potential loss, though, according to the book, this is often accepted as a necessary trade-off to a high growth strategy.

Final thoughts

Clearly real estate is something that needs to be thought about as part of a long-term strategy and with the help of professionals. And some of this is probably not applicable to start-ups in the retail-space. That said, choosing a location by itself is already a science—whether you rent, lease, buy, or build it. And both the direct costs—purchase or rent—and indirect costs—development, running, and contextual—will play an important part in the decision-making and business-planning.

Until now, I have mainly covered the issue of competition and cost in relation to a real-estate strategy. I'll probably not go into population and accessibility just yet, and will instead focus more on more complicated tools used in real estate strategy, beyond the simple checklist, which I covered in my first post on this. These include mathematical, mapping, and some other models, as well as, hopefully, some more data on the role of IT in this process.

For a more in-depth reading, I of course recommend buying the book on Retail Marketing, which largely inspired this article.

Filed under: books, business strategy, entrepreneurship, finance, geography, logistics, new business development, operations, real estate, Research, retail, supermarkets, tools

I've written two posts in the past, reviewing Gladwell's books, Blink and The Tipping Point. Both posts are no longer online and thus game for reproduction. Following will be these two reviews (lightly edited), which were already rather short, and would make for a good marketing-related interlude.

"The Tipping Point - How Little Things Can Make a Big Difference" (reviewed October 2006) I read The Tipping Point by Malcolm Gladwell, about a year ago, a slightly older book from 2000, but with some timeless insights on viral marketing and tipping the user-adoption scale.

I read The Tipping Point by Malcolm Gladwell, about a year ago, a slightly older book from 2000, but with some timeless insights on viral marketing and tipping the user-adoption scale.

Essentially, the author takes takes cues from biology and epidemiology to explain how ideas can spread like virusses, facilitated by three key-players: Connectors, Mavens, and Salesmen. Each of these play a role at different stages of the adoption process, with Mavens acting as the knowledgeable early adopter, the Connectors acting as hubs between groups of user, and Salesman taking care of the last mile, the mainstream-market.

The book explains how people take in information, using a variety of examples from TV-shows to Sneakers, as well as how companies can shape their marketing-efforts to gain access to those three key-figures. Only in the afterword, does Gladwell cover issues like email and the rule of 150 - the latter refers to “Dunbar's Number,” which proposes there are limits to our cognitive social functions and that it's only possible to actively maintain a certain sized (150 people) social circle (Whether this still applies today can perhaps be disputed).

The Tipping Point does a fairly good job in translating social theories to practice, better so than recent attempts like Freakonomics (which, in my opinion, was too abstract), and the insights will continue to be relevant. That said, I expect that some trendspotting-practices of companies will change, or have changed drastically since the time of writing, in the sense that consumer-driven products seem to be taking off, as well as “long-tail” business (which may or may not be the same thing) . Perhaps his newest book, Blink, corrects this.

"Blink - The Power of Thinking Without Thinking" (reviewed December 2006) “If you Blink, you're dead!” This must be a phrase you hear in movies often, mostly when one character has a gun pointed at another (editor: seriously, this must be the corniest start of a post ever). Gladwell has definitely taken this phrase to an extreme, attempting to research everything about it.

“If you Blink, you're dead!” This must be a phrase you hear in movies often, mostly when one character has a gun pointed at another (editor: seriously, this must be the corniest start of a post ever). Gladwell has definitely taken this phrase to an extreme, attempting to research everything about it.

My first reaction when hearing this book was “Malcolm, what were you thinking when wrote this book?” The space of two seconds—the time it takes to blink—turns out to be gigantic and many people wouldn't even know where to begin exploring what happens there. But mr. Gladwell does his best, looking through the lenses of experts from various disciplines and giving a broad range of examples.

The book starts with describing the purchase of a statue by a museum. After consulting many experts they decide the statue is authentic and pay a huge sum for it. Then, however, another expert, one from the field this time, takes a quick look and feels something is wrong with it. And he's right, the statue is in fact a fake. Malcolm Gladwell asks the question as to why some people have an instinct that can judge things, people, and situations more quicly, than studied experts can over the space of weeks, months, or years. The answer is perhaps obvious: practice.

Following this example, Gladwell proceeds to describe the fields of rleationship-therapy, facial recognition science, security, sociology, and some others, where the practice of instinct, or rather the rapid understanding of situations, is very important, so much so that there are therapists that can predict whether a relationship will end quickly or last forever, are able to tell if you're lying, can teach policemen to judge whether a person is drawing a gun or a mobile phone. But where the book really shines is in understanding where racism and discrimination comes from, which, Gladwell shows, can have deadly consequences in fields like police-work, and which continues to be relevant in today's polarised society.

I see Blink as a book aimed at experts, but sold in a mainstream-market. There are principles in the book which are clearly valuable to everyone, yet to get there it takes hard work and practice. But, having read and reviewed his previous book, The Tipping Point, I believe the point is not for the reader to become a genius. Rather, it's to surround yourself with the right people that have access to this knowledge. The example of the museum clearly shows the usefulness of this.

For further reading you may want to check out this Scientific American Mind article, on the science behind facial recognition (and exposing lies).

Final thoughts

Blink and the Tipping Point are at different points in Gladwell's evolutionary scale, and I think, judging by his latest speech and his soon-to-be-released book on "the workplace of the future," he's more and more moving towards understanding the upper regions of the brain. At the same time, an inherent risk in this approach is usually that you forget that there are real people involved, and I don't get a sense that this is happening.

Rather, when you listen to his speech on the nature of intelligence, and read his books, you see that he is very careful to understand the context of why something happens, not just the occurrence itself. And that context alone makes for some excellent reading, because I suspect that that is one of of the secret ingredients to becoming one of the geniuses that Gladwell describes.

Filed under: books, career, customers, ethics, human resources, innovation, interlude, management, marketing, retail, self-development, tools

Let's start with a brief disclaimer: I am not a lawyer, fiscal expert, EU expert, or anything that can constitute an authority in matters of European legislation. I have linked to relevant data at the end of this article, which I strongly encourage interested readers to check out.

SEPA, meaning “Single Euro Payments Area,” is an initiative, due to be launched in 2008 and fully implemented by 2010, but has been in the planning ever since the EURO-currency was unleashed upon the member-countries in 2002.

Essentially, while the EURO brought some transparency to consumers, banks, and businesses on a cash-level, SEPA is meant to be the non-cash equivalent, introducing a common standard of non-cash transfers between banks, businesses, and consumers across the EU-region. This is facilitated by a standard referred to as "straight-through processing" (STP), which allows for an automated processing of payments between banks.

Technically speaking, this means that payment-messages between parties will contain certain data-elements that include information on the amount, bank account details and the names of the sender and receiver, and is exchanged between banks through a common ISO-standard, called: UNIFI (ISO 20022) XML.

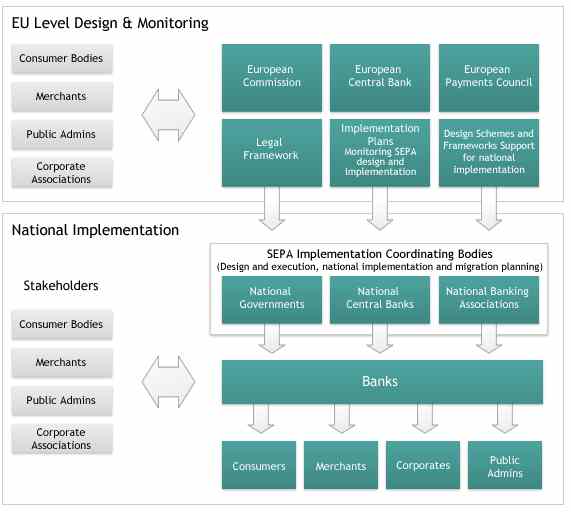

All of this mumbo-jumbo is governed by the European Payments Council (EPC) (see pic below), which is the decision making and coordination body of the European banking industry in relation to payments, and consists of 67 members, including banks and banking associations.

(click picture for more detail)

Benefits to consumers and businesses

These are manifold. Essentially, a harmonised standard allows consumers to easily, transparently, and securely make payments across borders, which also means that consumers don't need to open separate banks to handle their business in different European countries. In addition to this, it introduces a common standard for pension-transfers across banks (and I assume countries), and greatly increases the choice of financial service providers to consumers.

For businesses, the benefits are far more numerous. Essentially, having shared standards allows them to easily accept and process payments from any card from a SEPA-bank. National borders no longer need to be a barrier to growth and businesses can have a more direct financial relationship with consumers across the Euro-region. Similarly, B2B-transactions across borders enjoy similar "upgrades" and will require much less overhead, be more transparent, secure, and quicker than before.

For a more exhaustive list of changes, please check the EPC-report on Making SEPA a reality!

Final thoughts

While this all sounds very rosy-coloured, I expect that the key-factor will be marketing, i.e. communication about what SEPA is and how to use it. So far, there has been very little news on SEPA, even though it is due to be launched in less than 3 months from now. Similarly, a status-report by the EPC (pdf) points out that there has been very little communication from public authorities about their intention of using SEPA products, and another Dutch article, from a few days ago, reports that 92% of Dutch business-owners are not yet prepared for SEPA.

That said, if anything was needed after the EURO was introduced, it was increased transparency of financial services, and preferably on a pan-European level. Both the fact that businesses and consumers can run their financial affairs from a single bank in a single country, and that both also have more choice of service providers, is a huge improvement. For the latter, I hope the increased competition will lead to more efficient financial services. And for the first, I hope it will lead to more businesses expanding their operations across national borders, and more migration by European citizens across the continent.

Of course, much remains to be done before we can truly call Europe one "country," including a more harmonised patenting-standard, and of course overcoming many of the legal and cultural barriers which continue to exist. But the SEPA, if all goes according to plan, is a significant step ahead towards making this a reality.

Some helpful links

- The European Central Bank on SEPA

- The European Payments Council on SEPA

- EPC-report on Making SEPA a reality (very good to read!)

- Latest SEPA status-report

Filed under: customers, e-commerce, entrepreneurship, Europe, finance, Globalisation, innovation, Legalese, Politics, Research, retail, SEPA

This is part I of my coverage on IKEA's growth, based on my reading of the book "The 11 secrets of IKEA" (more on this at the end of this article). You can read a previous blogpost on IKEA's "strange alien values" here. I'll continue this series as follows. Starting with Scandinavia, I'll go into how Ikea grew in this area. I'll then continue with Europe, and finally finish with the giants, the USA, China, and Russia.

Some years ago, I worked on a project where we would try to find out how businesses expanded internationally. In this case, we looked at the tire-industry, and three companies, Bridgestone, Goodyear, and Michelin, and dug through tons of annual reports and news-releases to understand where, when, how, and why these companies expanded beyond their national borders.

Some years ago, I worked on a project where we would try to find out how businesses expanded internationally. In this case, we looked at the tire-industry, and three companies, Bridgestone, Goodyear, and Michelin, and dug through tons of annual reports and news-releases to understand where, when, how, and why these companies expanded beyond their national borders.The reasons these three companies make such an excellent case-study, is that they all originated from different continents and thus reflect different cultures. It is nearly an unwritten rule that US-companies perceive the world as a single market and make little effort to adapt to local conditions; that Japanese companies are very hierarchical in their structure; and that European companies, as a consequence of the cocktail that is Europe, internationalise quite quickly (or not at all). And for all international activities, it is another soft rule that they would expand to countries with some cultural, legal, and linguistic similarities first.

IKEA is of course a European firm, or rather, a Swedish one, and a preliminary conclusion would be that it would internationalise quite quickly also, yet starting in Scandinavia, then the rest of Europe, then the world. Another assumption would be that it would thread carefully (read: slowly or not at all) in areas which reflected alien values (to IKEA). As will be shown, this did indeed happen.

Ingvar Kamprad and Sweden

A business usually has different components, many of which reflect the values of the founder, and again the values of the society he or she grows up in. IKEA's founder, Ingvar Kamprad, was born in 1926, on a small farm in Sweden. He respected the feeling of community he experienced there. His grandmother, who had migrated from Germany at the end of the 19th century, taught him the value of hard work and encouraged his entrepreneurial spirit.

Ingvar Kamprad had started IKEA as an import-export business, and much of the way IKEA would be run would reflect that idea. When you're a trader, the idea is that the product doesn't matter and to be as efficient as possible (a modern-day example: eBay). In order to save costs, IKEA tried to get preferential treatment with its suppliers, started with selling products via mail-order, and ultimately set up a storefront, which was actually just a warehouse.

Of course, Sweden itself, with its strong socialist values, had a large degree of influence in the way IKEA took shape. Internally, the business was run quite informally, and in many ways reflected the communal environment where Ingvar Kamprad had grown up in. Similarly, the business of IKEA was not meant to be elitist, rather aimed at middle-class families, a large component of Swedish society. Sweden also had a long tradition in furniture and design and that was another influential factor.

IKEA

IKEA was set up in 1943, already a successful mail-order business, and soon after Kamprad would start a business-degree to learn the theory of distribution. After some years of studying, working for other businesses, and finally military service, IKEA's first employee was hired in 1948. This was also the year that Kamprad decided he wanted to make IKEA big and to that effect, started a folder-campaign via a regional newspaper.

The competition in this business was tough, however, plenty of mail-order-businesses in Sweden, and the competitive landscape orientated itself around lowering prices. A natural consequence was that the quality of products also went down. Because Kamprad was made aware of this through countless letters from customers, he came up with the idea of having customers check the products themselves, which is how IKEA, the store, was born.

Two features were important here, one was that the primary way to order was still the catalogue, and the store a complementary service. And two, the self-assembled furniture, which grew out of the need to ship products more safely. This also brought a new degree of involvement by IKEA with their suppliers, essentially bringing innovation upstream, which help suppliers to save costs, and downstream, as self-assembly became a large cost-saver for customers also.

At the same time, IKEA's new retail-focus brought in a new level of competition, that of other furniture-retailers. Afraid of the popular and far cheaper business-model of Kamprad's, and angry at the obvious copying of designs that IKEA was doing also, these retailers started pressuring local suppliers to no longer work with IKEA. This forced Kamprad to use some questionable business-practices, such as starting anonymous daughter-companies to deal with these suppliers, amongst others. In the end, it also lead to him to having to look abroad for new suppliers, which I will write more extensively about in following blogposts.

Noteworthy was that before expanding to the Swedish capital, Stockholm, IKEA had already opened an outlet in Oslo, Norway's capital, in 1963. Two years later, the first IKEA was opened in Stockholm, which turned out to be a massive success. IKEA was well-fitted for the times also. The Swedish socialist government had implemented an ambitious plan for urbanisation, which involved building a million houses between 1965 - 75. Since IKEA was well-able to meet the booming demand for cheap furniture, this was a match made in heaven.

In 1971, IKEA unleashed another innovation. A restaurant, which served food to the clientele at affordable prices. This was another way for IKEA to become a lifestyle-trendsetter, and also started the urban legend that meatballs were Swedish (IKEA's recipe was actually British).

Scandinavia

While IKEA was already established in Norway, and had suppliers in Denmark, it opened its first retail outlet there also, in 1969. Towards the end of the 70s, there were altogether 6 different IKEA-stores in the rest of Scandinavia. All of which were personally owned by Ingvar Kamprad.

It was not long after, 1973, that he and his family also moved to Denmark, to flee the insane taxation-system in Sweden, which I explained in my last post.

Final thoughts

Clearly, much of what made IKEA successful world-wide, started with innovations introduced in Sweden. IKEA's mail-order- and warehouse-model, its close integration with suppliers, its focus on providing cheap lifestyle products, and also its internal frugality—which I did not speak of, but IKEA-employees are traditionally paid below market-value. All of which fits with my philosophy of "where you are from and when you are from matters a great deal to where you are going."

IKEA's international expansion started with Scandinavia, which was a region with a lot of cultural similarities to Sweden. As I will explain later, this is a trend that would continue in Europe also. At the same time, the reason that IKEA expanded internationally, could also in large part be explained by the competitive pressures inland—IKEA's troublesome relationship with Swedish suppliers—and with the socialist regime, which was largely incompatible with running a profitable business, and forced Ingvar Kamprad to look elsewhere for a more business-friendly environment. This was also the philosophy, when expanding into Europe, which I describe in a future post.

All in all, IKEA makes an interesting case-study, because it is a European business, and it is interesting to see which of its values were compatible with other countries and which countries presented more difficulty and why. Much more on this in future posts.

The book "The 11 secrets of IKEA" is sadly not available in English. If you do read Dutch, I do recommend picking the book up here, and for German, check the German Amazon-store here. For other book-reviews, check out my look at eBay's "The Perfect Store" here, McDonalds "Grinding It Out" here and here, as well as at Starbucks' "Pour Your Heart Into It" here and here. The picture is courtesy of Culinaryartsblog.com

Filed under: books, business strategy, community, culture, customers, design, entrepreneurship, Europe, Globalisation, Ikea, innovation, logistics, operations, retail, supply chain managment

5 links to think - on Japan, designing experiences, globalisation, and endorsements

0 comments Posted by Unknown at 3:12 PM Really no shortage of interesting links this week, which is always nice. At the same time, it makes choosing 5 that much harder, but here goes.

Really no shortage of interesting links this week, which is always nice. At the same time, it makes choosing 5 that much harder, but here goes.

- An Alien in Japan: Charlie Stross describes his trip to Japan last summer. …From Yokohama to Tokyo to Kyoto; …about shaved cats, getting lost in shopping malls, to Hello Kitty, and extreme bathing, to monorails and re-building history. A very interesting read, which presents some insights into that alien world, Japan.

- Blasting scents into coffee-consumers' brains: Roger Dooley explains the importance of environment to sensory experience, and describes how Nestle's Nespresso found their way into people's noses, brains, and hearts. In coffee, just as with good food and wine, scent is everything! Food for thought.

- Can experience be designed? After reading Bob Jacobson's essay, I'm not so sure. He writes about placing human experience into the centre of the design process, about systemic relationship between information and the environments (see above link as an example), about the difference between user- and human experience design, and how you can probably never design an experience to completely meet a person's expectations. At least, I think that's what he writes. So much of this text is far above my head, but worth reading to guide your mind into new directions, and a must-read for anyone interested in creating experiences. It's all a pre-cursor to a book, which, judging by the range of material, I expect to be published in 2 to 5 years, but which will be well-worth the wait. In the meantime, check out Bob's great blog.

- The downside of franchising: Richard Layman, in his artsy urban blog, writes about how franchises have transformed L.A.… into a clone of just about any other city. A little anecdote: I observed a similar trend when I was last in Belgrade, Serbia, which I hadn't visited since the war. It looks just the same as any other city, and that's sad because I remember there being a lot more authentic clothing- and food-venues. When I see this, I'm not sure I'm a fan of globalisation, or franchising for that matter.

- A twosie on Human brand-carriers (Sounds like a disease, doesn't it?): Two articles discuss this, one, by the NY-Times, on rock-stars and their interaction with brands. As one artist put it: "The barriers are changing and we as artists are making less and less money, and we have to get creative." At the same time, I have great sympathy for artists like Springsteen, Tool, and N.I.N., who refuse to corrupt their art. And another article, by HBR, on endorsements in sports, which is, at last count, a 100 billion dollar industry. I'm fascinated by this phenomenon, so maybe I'll write something about it in the future.

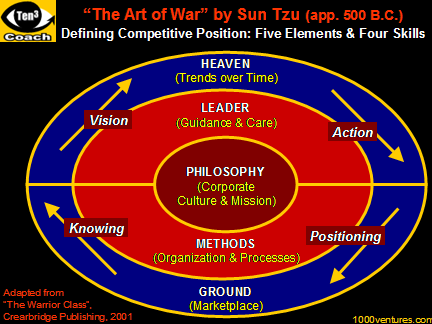

"The nature of water is that it avoids heights and hastens to the low-lands. When a dam is broken, the water cascades with irresistabke force. The shape of an army resembles water. To take advantage of an army's unpreparedness, attack him when he does not expect it, avoid his strength and strike his emptiness. And like water, man can oppose you."Tsung Yu in The art of war

In my last article on the subject of real estate, I mentioned four areas which retailers must focus on: population, accessibility, competition, and cost. This was taken from the book Retail Marketing, whose author, Dr. Peter McGoldrick, taught me the subject some years ago.

In my last article on the subject of real estate, I mentioned four areas which retailers must focus on: population, accessibility, competition, and cost. This was taken from the book Retail Marketing, whose author, Dr. Peter McGoldrick, taught me the subject some years ago. Of these four, the one I like the most is competition, as, like in the quote, it can be somewhat fluid, it's about people, and it can drive innovation. There's actually two ways to think about competition: as either a destructive, or as a synergetic force. I'll go into both modes of thinking, and hopefully looking at it through the lens of real estate helps.

The nature of real estate competition is quite complex. For one, it is hard to take into account indirect competition such as substitutes, and difficult to guess the response that your presence will have on existing retail outlets. In addition to this, all the other factors—cost, population, and accessibility—can affect your competitive potential. Say that you settle down into an area outside of the city, and a competitor decides to intercept customers on their route to you, by placing their outlet in a more convenient location. Any real-estate strategy has to take these possible contingencies into account, hopefully not allowing them to happen all together.

There are also different ways to think about market-saturation, and I expect most cities can appear fairly saturated nowadays. But not all hope is lost. For one, new business can drive old ones out of business. Second, large areas may contain local pockets which can still present opportunities. And third, new retail-formats (some examples here) can enable large superstores to still compete in smaller markets.

The issue of magnetism is another very important factor. Not all competition is bad, rather certain anchor stores, even if they compete with you, can drive a lot of traffic your way. Studies have shown that the presence of these anchor-stores can severely benefit your store's profitability. These anchors can sometimes be single stores, e.g. a Starbucks, or groupings of smaller stores, e.g. fashion, antiques, etc.

Similarly, grouping with other stores can severely reduce the cost of doing business (e.g. shared parking and security), and also act as a risk-reducing factor.

There should be some caution, however. While a study by Brown in 1991 (see book) showed that shoppers were 35% more likely to visit adjacent stores that were of similar type (vs. the dissimilar kind), this only applied to comparison and convenience goods, and more specifically to clothing, department, and variety shops, but not to retail services! And I assume that the latter includes places like coffee-shops and mobile phone-stores.

Hopefully, that was a little more concrete than my last introductory post on this. Of all things relating to entrepreneurship, the real-estate part is the one that is probably the most complex, and it would definitely be advisable to work with real professionals on this—though understanding the issues always helps.

The picture is courtesy of 1000ventures.com

Filed under: business strategy, community, customers, entrepreneurship, geography, operations, real estate, Research, restaurants, retail, supermarkets

HBR writes about this rule, and Malcolm Gladwell (picture) speaks about it. Essentially, it means that being an expert at anything does not require any special talent (though liking what you do, helps), but instead it requires 10,000 hours of dedicated practice. This applies just as much to musicians, as to technologists, as to retail-entrepreneurs.

HBR writes about this rule, and Malcolm Gladwell (picture) speaks about it. Essentially, it means that being an expert at anything does not require any special talent (though liking what you do, helps), but instead it requires 10,000 hours of dedicated practice. This applies just as much to musicians, as to technologists, as to retail-entrepreneurs.

Take Candy Dufler, whom I wrote about the other day. She's been playing saxophone since I don't know when, but the hit "Lily was here" is approximately 20 years old. And if you calculate that 10 hours per week of practice, multiplied by 20 years, equals 10,000 hours, and combine that with Dave Stewart's compliment on her "encyclopaedic knowledge of riffs," you understand that she's an expert in her craft.

The point about all this is that anything can be mastered with sufficient practice. Malcolm Gladwell adds to this that this practice is not a solitary activity either, nor is it a matter of simple repetition. Rather it is imperative that it is guided by other experts and mentors, much like Dave Stewart is to Candy Dufler. And it has to push the boundaries, entering areas where the comfort-zone is low.

I think about this 10,000 hour principle a lot. It is very relevant to blogging, for instance. We, the people, are surrounded by experts, be it writers for the Financial Times or Harvard Business Review, or bloggers like Nick Carr, Seth Godin, and countless others. And we reproduce their writing to form a synthesis of it, eventually building a collaborate bucket of knowledge. This is why blogging is great, because it is open, it is curious, and, on the aggregate, self-correcting. But to individuals, it is only beneficial if part of a long-term strategy of dedicated learning and application.

The "Rule" also offers insights into hiring people and finding jobs. If your future employee is not happy (or able) to share his or her know-how, then how can your other employees (or yourself) increase their expertise? And if your job consists of spending countless hours behind an excel-sheet, locked away in a room, then may I suggest that that is what they call dead-end? Alternatively, if you can find someone who can actually present proof that they have 10,000 hours of applied practice behind them (or even half that!), you can feel pretty good about hiring them, and vice versa, they can feel pretty confident that they can add value to the area which they have practised for.

Ultimately, this kind of thinking suggests that we can only improve, and indeed innovate, as people, businesses, or products, by opening up to a ton of information, for a long-long-long time, perhaps forever. In other words, long live the open economy, the tools that connect us, and the computer that is our brain.

Filed under: blogging, career, culture, human resources, innovation, management, Research, retail, self-development, trends

Thinking about Real Estate - holistic approach & checklists

0 comments Posted by Unknown at 11:08 AM I don't know anything about real estate. My sister wants to buy an apartment in Dublin. My father used to own several houses in Germany, the Netherlands, and Belgium. Back in his day, banks were much more liberal about lending money to house-buyers, often sponsoring up to 90% (I think). The climate is far less friendly now and I hope my sis has better luck in Ireland, where house-prices are booming.

I don't know anything about real estate. My sister wants to buy an apartment in Dublin. My father used to own several houses in Germany, the Netherlands, and Belgium. Back in his day, banks were much more liberal about lending money to house-buyers, often sponsoring up to 90% (I think). The climate is far less friendly now and I hope my sis has better luck in Ireland, where house-prices are booming.