If you read further into the ACNielsen-report (pdf), I wrote about two days ago, you'll have seen that retailers' private label-strategy seems to be focussed on certain key-areas, namely:

- General health

- Weight-loss

- Organics / Fair Trade

- and Food for kids

At the same time, there are lot of savings on the marketing side for private labels. Retailers are in fact huge market research factories—every move that a customer makes in their store, with their products, can be entered into a database and used for future marketing strategies.

And having full control over shelf-space, shelf-placement, and in-store marketing means that the budget for these can be minimised.

All of which has three implications:

- That more of the budget can be allocated to the quality of private label products.

- That it pays off to have an elaborate in-store-system to collect consumer-data.

- And that independent product-manufacturers are perhaps screwed.

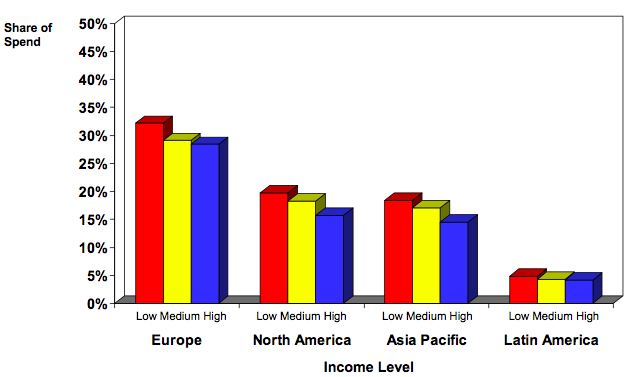

Figure 1: Private label share of spend segmented by income level (source: ACNielsen, 2005)

Of course, this doesn't mean that independent product-manufacturers are completely screwed. It puts pressure on them to become more innovative with their products and marketing than they ever were before. Which is the right kind of pressure.

Final thoughts

There's not much not to like about private labels. In many ways it's a more efficient system. Less time and money needs to be spent on the marketing-side, and more can spent on the back-end—the production. At the same time, independent manufacturers will have the advantage of flexibility. They can (perhaps) adapt quicker to market-trends, or perhaps even lead them.

Not all market-research needs to happen in the store either, some also needs to happen where the consumption happens—at home or elsewhere. And large independent manufacturers perhaps have a better foothold on general trends in society, than retailers, who are mostly restricted to what happens in their store.

(On a related note, one of my early posts on this blog discussed P&G's strategy towards shopper-marketing, worth checking out!)

So it's perhaps not a black-and-white situation. But I think that, looking at Starbucks, which is essentially a private label, that this strategy has considerable merit, because it gives retailers a lot of power over the quality of these products and how these are sold. It essentially shifts the brand up towards the retailer, instead of it remaining on the product-level.

More on this as I come across it.

Filed under: branding, business strategy, food, innovation, marketing, private labels, Research, retail, starbucks, supermarkets, suppliers, trends

Private Labels II - thoughts about trends and patterns

If you read further into the ACNielsen-report (pdf), I wrote about two days ago, you'll have seen that retailers' private label-strategy seems to be focussed on certain key-areas, namely:

At the same time, there are lot of savings on the marketing side for private labels. Retailers are in fact huge market research factories—every move that a customer makes in their store, with their products, can be entered into a database and used for future marketing strategies.

And having full control over shelf-space, shelf-placement, and in-store marketing means that the budget for these can be minimised.

All of which has three implications:

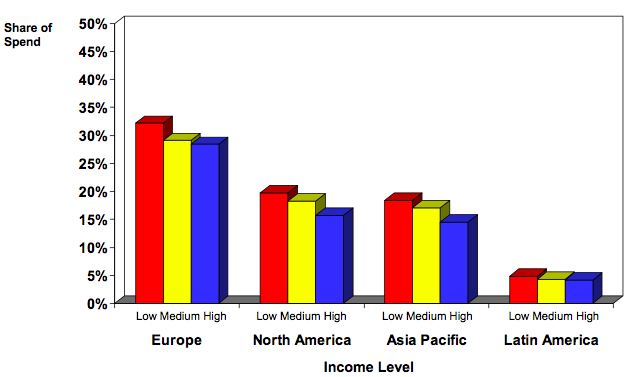

Figure 1: Private label share of spend segmented by income level (source: ACNielsen, 2005)

Of course, this doesn't mean that independent product-manufacturers are completely screwed. It puts pressure on them to become more innovative with their products and marketing than they ever were before. Which is the right kind of pressure.

Final thoughts

There's not much not to like about private labels. In many ways it's a more efficient system. Less time and money needs to be spent on the marketing-side, and more can spent on the back-end—the production. At the same time, independent manufacturers will have the advantage of flexibility. They can (perhaps) adapt quicker to market-trends, or perhaps even lead them.

Not all market-research needs to happen in the store either, some also needs to happen where the consumption happens—at home or elsewhere. And large independent manufacturers perhaps have a better foothold on general trends in society, than retailers, who are mostly restricted to what happens in their store.

(On a related note, one of my early posts on this blog discussed P&G's strategy towards shopper-marketing, worth checking out!)

So it's perhaps not a black-and-white situation. But I think that, looking at Starbucks, which is essentially a private label, that this strategy has considerable merit, because it gives retailers a lot of power over the quality of these products and how these are sold. It essentially shifts the brand up towards the retailer, instead of it remaining on the product-level.

More on this as I come across it.

- General health

- Weight-loss

- Organics / Fair Trade

- and Food for kids

At the same time, there are lot of savings on the marketing side for private labels. Retailers are in fact huge market research factories—every move that a customer makes in their store, with their products, can be entered into a database and used for future marketing strategies.

And having full control over shelf-space, shelf-placement, and in-store marketing means that the budget for these can be minimised.

All of which has three implications:

- That more of the budget can be allocated to the quality of private label products.

- That it pays off to have an elaborate in-store-system to collect consumer-data.

- And that independent product-manufacturers are perhaps screwed.

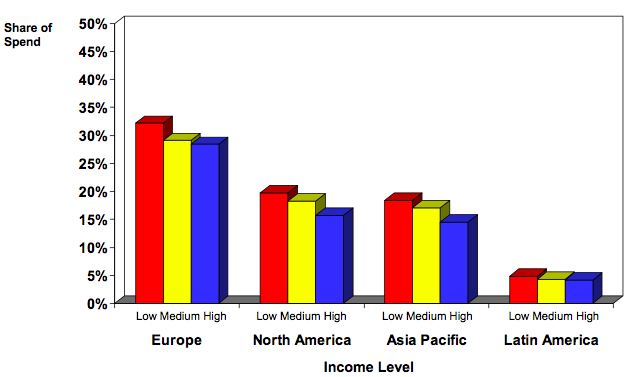

Figure 1: Private label share of spend segmented by income level (source: ACNielsen, 2005)

Of course, this doesn't mean that independent product-manufacturers are completely screwed. It puts pressure on them to become more innovative with their products and marketing than they ever were before. Which is the right kind of pressure.

Final thoughts

There's not much not to like about private labels. In many ways it's a more efficient system. Less time and money needs to be spent on the marketing-side, and more can spent on the back-end—the production. At the same time, independent manufacturers will have the advantage of flexibility. They can (perhaps) adapt quicker to market-trends, or perhaps even lead them.

Not all market-research needs to happen in the store either, some also needs to happen where the consumption happens—at home or elsewhere. And large independent manufacturers perhaps have a better foothold on general trends in society, than retailers, who are mostly restricted to what happens in their store.

(On a related note, one of my early posts on this blog discussed P&G's strategy towards shopper-marketing, worth checking out!)

So it's perhaps not a black-and-white situation. But I think that, looking at Starbucks, which is essentially a private label, that this strategy has considerable merit, because it gives retailers a lot of power over the quality of these products and how these are sold. It essentially shifts the brand up towards the retailer, instead of it remaining on the product-level.

More on this as I come across it.

Subscribe to:

Post Comments (Atom)

The

The