Let's start with a brief disclaimer: I am not a lawyer, fiscal expert, EU expert, or anything that can constitute an authority in matters of European legislation. I have linked to relevant data at the end of this article, which I strongly encourage interested readers to check out.

SEPA, meaning “Single Euro Payments Area,” is an initiative, due to be launched in 2008 and fully implemented by 2010, but has been in the planning ever since the EURO-currency was unleashed upon the member-countries in 2002.

Essentially, while the EURO brought some transparency to consumers, banks, and businesses on a cash-level, SEPA is meant to be the non-cash equivalent, introducing a common standard of non-cash transfers between banks, businesses, and consumers across the EU-region. This is facilitated by a standard referred to as "straight-through processing" (STP), which allows for an automated processing of payments between banks.

Technically speaking, this means that payment-messages between parties will contain certain data-elements that include information on the amount, bank account details and the names of the sender and receiver, and is exchanged between banks through a common ISO-standard, called: UNIFI (ISO 20022) XML.

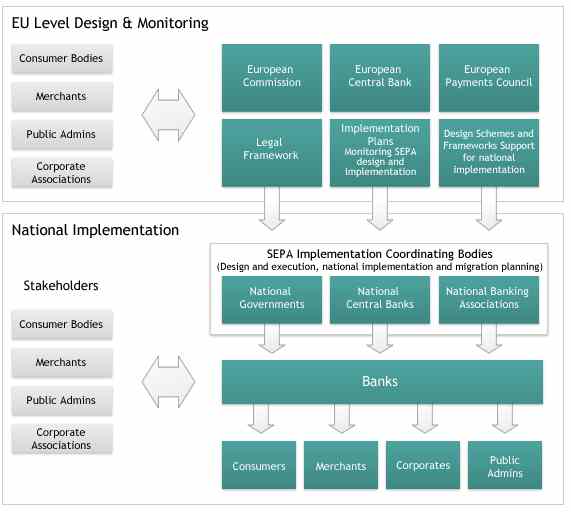

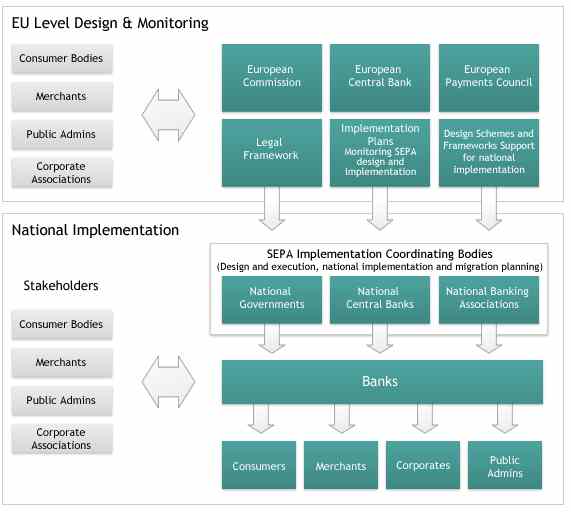

All of this mumbo-jumbo is governed by the European Payments Council (EPC) (see pic below), which is the decision making and coordination body of the European banking industry in relation to payments, and consists of 67 members, including banks and banking associations.

(click picture for more detail)

Benefits to consumers and businesses

These are manifold. Essentially, a harmonised standard allows consumers to easily, transparently, and securely make payments across borders, which also means that consumers don't need to open separate banks to handle their business in different European countries. In addition to this, it introduces a common standard for pension-transfers across banks (and I assume countries), and greatly increases the choice of financial service providers to consumers.

For businesses, the benefits are far more numerous. Essentially, having shared standards allows them to easily accept and process payments from any card from a SEPA-bank. National borders no longer need to be a barrier to growth and businesses can have a more direct financial relationship with consumers across the Euro-region. Similarly, B2B-transactions across borders enjoy similar "upgrades" and will require much less overhead, be more transparent, secure, and quicker than before.

For a more exhaustive list of changes, please check the EPC-report on Making SEPA a reality!

Final thoughts

While this all sounds very rosy-coloured, I expect that the key-factor will be marketing, i.e. communication about what SEPA is and how to use it. So far, there has been very little news on SEPA, even though it is due to be launched in less than 3 months from now. Similarly, a status-report by the EPC (pdf) points out that there has been very little communication from public authorities about their intention of using SEPA products, and another Dutch article, from a few days ago, reports that 92% of Dutch business-owners are not yet prepared for SEPA.

That said, if anything was needed after the EURO was introduced, it was increased transparency of financial services, and preferably on a pan-European level. Both the fact that businesses and consumers can run their financial affairs from a single bank in a single country, and that both also have more choice of service providers, is a huge improvement. For the latter, I hope the increased competition will lead to more efficient financial services. And for the first, I hope it will lead to more businesses expanding their operations across national borders, and more migration by European citizens across the continent.

Of course, much remains to be done before we can truly call Europe one "country," including a more harmonised patenting-standard, and of course overcoming many of the legal and cultural barriers which continue to exist. But the SEPA, if all goes according to plan, is a significant step ahead towards making this a reality.

Some helpful links

- The European Central Bank on SEPA

- The European Payments Council on SEPA

- EPC-report on Making SEPA a reality (very good to read!)

- Latest SEPA status-report

Filed under: customers, e-commerce, entrepreneurship, Europe, finance, Globalisation, innovation, Legalese, Politics, Research, retail, SEPA

SEPA, meaning “Single Euro Payments Area,” is an initiative, due to be launched in 2008 and fully implemented by 2010, but has been in the planning ever since the EURO-currency was unleashed upon the member-countries in 2002.

Essentially, while the EURO brought some transparency to consumers, banks, and businesses on a cash-level, SEPA is meant to be the non-cash equivalent, introducing a common standard of non-cash transfers between banks, businesses, and consumers across the EU-region. This is facilitated by a standard referred to as "straight-through processing" (STP), which allows for an automated processing of payments between banks.

Technically speaking, this means that payment-messages between parties will contain certain data-elements that include information on the amount, bank account details and the names of the sender and receiver, and is exchanged between banks through a common ISO-standard, called: UNIFI (ISO 20022) XML.

All of this mumbo-jumbo is governed by the European Payments Council (EPC) (see pic below), which is the decision making and coordination body of the European banking industry in relation to payments, and consists of 67 members, including banks and banking associations.

(click picture for more detail)

Benefits to consumers and businesses

These are manifold. Essentially, a harmonised standard allows consumers to easily, transparently, and securely make payments across borders, which also means that consumers don't need to open separate banks to handle their business in different European countries. In addition to this, it introduces a common standard for pension-transfers across banks (and I assume countries), and greatly increases the choice of financial service providers to consumers.

For businesses, the benefits are far more numerous. Essentially, having shared standards allows them to easily accept and process payments from any card from a SEPA-bank. National borders no longer need to be a barrier to growth and businesses can have a more direct financial relationship with consumers across the Euro-region. Similarly, B2B-transactions across borders enjoy similar "upgrades" and will require much less overhead, be more transparent, secure, and quicker than before.

For a more exhaustive list of changes, please check the EPC-report on Making SEPA a reality!

Final thoughts

While this all sounds very rosy-coloured, I expect that the key-factor will be marketing, i.e. communication about what SEPA is and how to use it. So far, there has been very little news on SEPA, even though it is due to be launched in less than 3 months from now. Similarly, a status-report by the EPC (pdf) points out that there has been very little communication from public authorities about their intention of using SEPA products, and another Dutch article, from a few days ago, reports that 92% of Dutch business-owners are not yet prepared for SEPA.

That said, if anything was needed after the EURO was introduced, it was increased transparency of financial services, and preferably on a pan-European level. Both the fact that businesses and consumers can run their financial affairs from a single bank in a single country, and that both also have more choice of service providers, is a huge improvement. For the latter, I hope the increased competition will lead to more efficient financial services. And for the first, I hope it will lead to more businesses expanding their operations across national borders, and more migration by European citizens across the continent.

Of course, much remains to be done before we can truly call Europe one "country," including a more harmonised patenting-standard, and of course overcoming many of the legal and cultural barriers which continue to exist. But the SEPA, if all goes according to plan, is a significant step ahead towards making this a reality.

Some helpful links

- The European Central Bank on SEPA

- The European Payments Council on SEPA

- EPC-report on Making SEPA a reality (very good to read!)

- Latest SEPA status-report

The

The