Essentially private labels, also sometimes called house brands, are products branded either with the name of the retailer, or, at times, sharing some kind of umbrella-name, decided by the distributor or otherwise. But what private labels really represent, to me, is the ultimate example of a power-struggle between a retailer and suppliers. Sometimes, but not always, it also means that some kind of vertical integration has been taking place between retailers and manufacturers, or, at the very least, packaging plants.

For now, I'll just be looking at some stats on private labels. At a later date, I'll take a look at more supplier-retailers dynamics, branding strategies, etc.

Geographic share

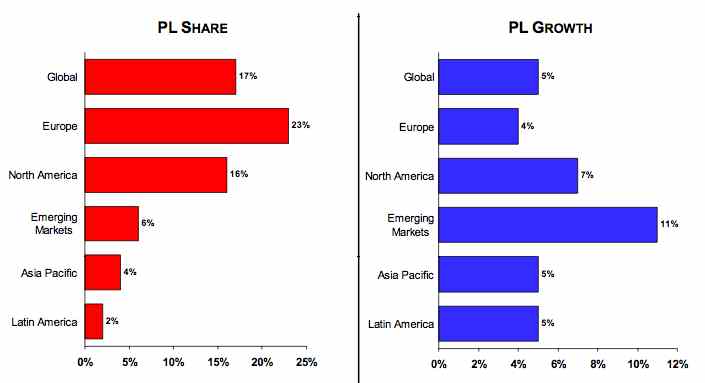

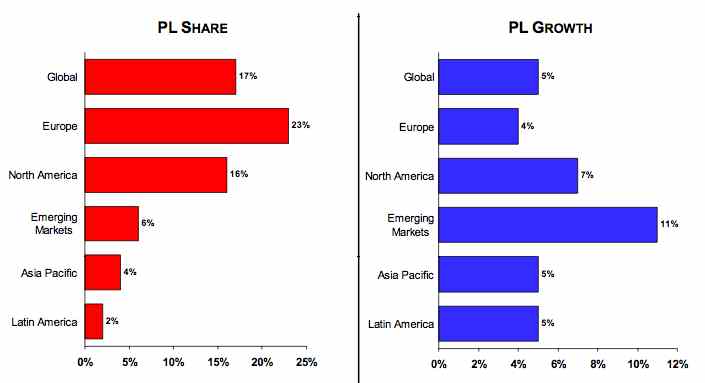

According to an ACNielsen report (pdf), the global* market-share for private brands was 17% in 2005 (* global meaning 38 countries and 80 categories), and had grown 6% that year.

Figure 1: Share & growth rates of private label by region (based on value sales) (source: ACNielsen, 2005)

Europe has the largest market-share with 23%, and Latin America the smallest, with 2%. Top countries included Switzerland, with 45%, Germany, with 30%, and the UK, with 28%. The largest Private Label growth happened, unsurprisingly, in emerging markets (11%) like Croatia (77%), Greece (24%), and Thailand (18%).

One big growth-contributor in Europe is the strong growth of hard discounters, such as Aldi or Lidl (both German chains), who are present in every European country and expanding rapidly. With Aldi, for instance, private labels make up 95% of sales.

Private label foods

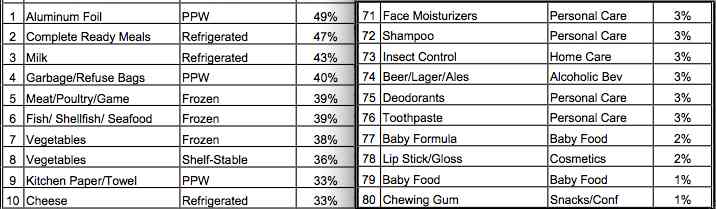

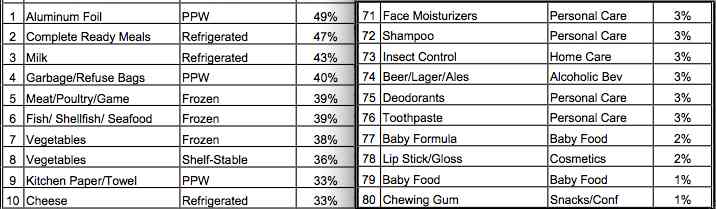

Category-wise, refrigerated foods have the largest overall share of private labels, namely 32%. Complete ready meals take the lead here, with an average of 47% private label-share. In the UK, 97% of ready-meal sales are in fact private label.

Another significant private label food, or rather drink, was milk, of which private labels make up 43% of sales.

Figure 2: Value shares of private label by category (source: ACNielsen, 2005)

Other high private label food-products include frozen meat (39%), fish (39%), and vegetables (38%), and 37% for shelved vegetables. Frozen pizza is at number 27, with 17%, tea and coffee at numbers 37 and 38, with 14% and 13% respectively. Wine is at number 44, with 12%. And Beer is all the way at the bottom, at number 74 with 3% !

Among the fastest growing foods are drinking yoghurt (28% growth), baby food (20%), chocolate (13%), and water (13%).

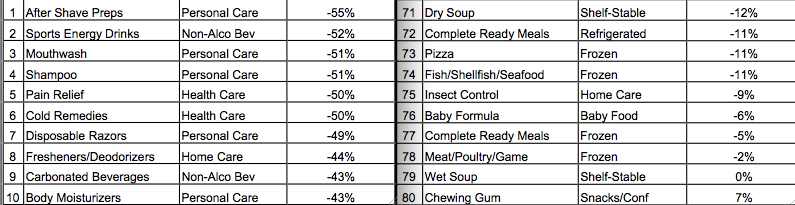

Pricing trends

One of the strengths of private labels is of course that they are cheaper, on average 31% less than manufacturer brands. Emerging markets showed the biggest discount, with PL-goods costing 41% less on average. Europe wasn't lagging in this respect either, with an average price difference of -37%. On a country level, Greece, Australia, and Germany were taking the lead with, respectively, -48%, -47%, and -46% discounts (compared to manufacturer brands).

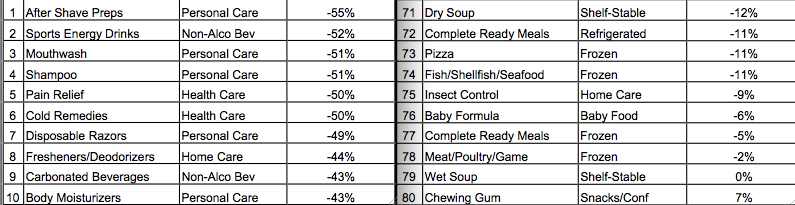

Figure 3: Price differential of private label by category (source: ACNielsen, 2005)

Again, concentrating on food-categories, the products that received the biggest discounts were Sports Energy Drinks (-55%), carbonated beverages (-43%), cereals (-40%), wine (-38%), and tea (-37%). Food-categories taking the least in discounts, included chewing gum (+7%), wet soup (no difference), meat (-2%), and ready meals (-5% <- I guess that explains their high market-share).

Final thoughts

That market share is increasing more quickly in emerging countries is not surprising. Retailers there will likely not be mature and/or consolidated enough to focus on such a strategy, but this is clearly changing.

Germany's dominance is also interesting, as both Aldi and Lidl originate from there. One of my next posts will be on Ikea's European growth and Germany's also very strong there, which suggests a certain preference for low prices with German customers.

Switzerland is still somewhat of an enigma, but I'll try to find out more about it.

In terms of products, both the dominance of private labels amongst ready-made meals, and that their prices are quite similar to regular brands, is very interesting. It could suggest that customers either don't care much for quality and brand-differentiation in that sector, or that private label brands are actually quite good. The price-level would suggest the latter conclusion.

Generally speaking, refrigerated goods are different in the eyes of consumers, I think, less scrutinised perhaps, and worthy of more investigation. Milk is of course similar to water, and hence not really a product where brand makes a huge difference.

What else? Certain beverages, like coffee, wine, and beer are quite interesting, as their private label share is quite low. This would suggest a high brand-sensitivity in these sectors. The low percentage for beer (3%) is certainly striking.

More on private labels as I come to it.

Filed under: branding, business strategy, Europe, food, geography, Globalisation, logistics, marketing, private labels, Research, retail, supermarkets, suppliers, supply chain managment, trends, USA

For now, I'll just be looking at some stats on private labels. At a later date, I'll take a look at more supplier-retailers dynamics, branding strategies, etc.

Geographic share

According to an ACNielsen report (pdf), the global* market-share for private brands was 17% in 2005 (* global meaning 38 countries and 80 categories), and had grown 6% that year.

Figure 1: Share & growth rates of private label by region (based on value sales) (source: ACNielsen, 2005)

Europe has the largest market-share with 23%, and Latin America the smallest, with 2%. Top countries included Switzerland, with 45%, Germany, with 30%, and the UK, with 28%. The largest Private Label growth happened, unsurprisingly, in emerging markets (11%) like Croatia (77%), Greece (24%), and Thailand (18%).

One big growth-contributor in Europe is the strong growth of hard discounters, such as Aldi or Lidl (both German chains), who are present in every European country and expanding rapidly. With Aldi, for instance, private labels make up 95% of sales.

Private label foods

Category-wise, refrigerated foods have the largest overall share of private labels, namely 32%. Complete ready meals take the lead here, with an average of 47% private label-share. In the UK, 97% of ready-meal sales are in fact private label.

Another significant private label food, or rather drink, was milk, of which private labels make up 43% of sales.

Figure 2: Value shares of private label by category (source: ACNielsen, 2005)

Other high private label food-products include frozen meat (39%), fish (39%), and vegetables (38%), and 37% for shelved vegetables. Frozen pizza is at number 27, with 17%, tea and coffee at numbers 37 and 38, with 14% and 13% respectively. Wine is at number 44, with 12%. And Beer is all the way at the bottom, at number 74 with 3% !

Among the fastest growing foods are drinking yoghurt (28% growth), baby food (20%), chocolate (13%), and water (13%).

Pricing trends

One of the strengths of private labels is of course that they are cheaper, on average 31% less than manufacturer brands. Emerging markets showed the biggest discount, with PL-goods costing 41% less on average. Europe wasn't lagging in this respect either, with an average price difference of -37%. On a country level, Greece, Australia, and Germany were taking the lead with, respectively, -48%, -47%, and -46% discounts (compared to manufacturer brands).

Figure 3: Price differential of private label by category (source: ACNielsen, 2005)

Again, concentrating on food-categories, the products that received the biggest discounts were Sports Energy Drinks (-55%), carbonated beverages (-43%), cereals (-40%), wine (-38%), and tea (-37%). Food-categories taking the least in discounts, included chewing gum (+7%), wet soup (no difference), meat (-2%), and ready meals (-5% <- I guess that explains their high market-share).

Final thoughts

That market share is increasing more quickly in emerging countries is not surprising. Retailers there will likely not be mature and/or consolidated enough to focus on such a strategy, but this is clearly changing.

Germany's dominance is also interesting, as both Aldi and Lidl originate from there. One of my next posts will be on Ikea's European growth and Germany's also very strong there, which suggests a certain preference for low prices with German customers.

Switzerland is still somewhat of an enigma, but I'll try to find out more about it.

In terms of products, both the dominance of private labels amongst ready-made meals, and that their prices are quite similar to regular brands, is very interesting. It could suggest that customers either don't care much for quality and brand-differentiation in that sector, or that private label brands are actually quite good. The price-level would suggest the latter conclusion.

Generally speaking, refrigerated goods are different in the eyes of consumers, I think, less scrutinised perhaps, and worthy of more investigation. Milk is of course similar to water, and hence not really a product where brand makes a huge difference.

What else? Certain beverages, like coffee, wine, and beer are quite interesting, as their private label share is quite low. This would suggest a high brand-sensitivity in these sectors. The low percentage for beer (3%) is certainly striking.

More on private labels as I come to it.

The

The